Table of Contents

Tax season is upon us. And since one in five Americans are family caregivers, millions of people across the country are caregiving: we have questions. Do family caregivers get tax breaks or do they pay taxes?

An average family caregiver spends about $7,200 a year on costs related to caring for someone. Paying taxes on top of that feels like a sucker punch.

We’ve done some legwork to help clear up some common questions about taxes and family caregiving.

Family caregivers, what's your tax status?

Check out our guide to learn who the IRS considers a family caregiver and how to proceed when filing taxes.

The short answer is: it depends. Let's look at the question from the IRS lens of what is your employment status, is the person you take care of defined as your dependent, where do you live in relation to the person being cared for, and who's responsible for withholding?

Who's paying you, how much, and where does the person being cared for live? Now, for the more extended questions and answers.

Family caregiver tax support partners

If you'd like help right now, we recommend expert resources to help you get it straight. However, when it comes to family caregivers and taxes, there are a lot of special rules and regulations.

add_merchants

Contact H&R Block for tax help, questions about family caregiving tax issues, and more.

Ensure your paperwork is for tax filing legal statuses with LegalZoom. They currently have a 15% off offer for our caregivers.

Get more help from e-file. They have specific teams that support caregiver tax concerns.

8 tax ccenarios:

Family caregiver or an employee

Family caregivers are not technically considered employees —even if they receive payment from insurance or a government program.

Suppose you are a professional caregiver employed by your family thru your agency. In these circumstances, family caregivers must report income and pay taxes.

Paid and professional care help

Families hire household help and caregivers to help with chores and dependents at home. If the house is the employer, there are different tax-defined employee statuses they need to be familiar with.

Some home support jobs are house cleaners, caretakers, health aides, private nurses, drivers, lawn services, or companions. In these cases, the family is an employer with tax responsibilities for household employees.

If you don’t run a caretaking business or work for one, you probably don’t have to pay taxes for caring for a family member. (Yep, even if you’re being paid by an insurance company to help with care duties.)

It is different if you or the person you hire work for a caretaking agency, run your own caretaking business, or employ an independent caretaker and get paid.

Non-professional caregiver

You do not pay taxes if you are a family member or friend paid to take care of someone from their insurance typically. A taxpayer does not owe an additional "self-employment tax" on amounts reported on the 1099-MISC received from an insurance company.

For example, you don’t pay taxes if you’re taking care of your spouse on disability leave from work. However, there are two cases in which you owe taxes for family caregiving.

- If you run an adult or child daycare out of your home and care for the family member as part of those services

- If you’re employed by a caretaking agency and have been assigned the responsibility from that agency.

If you receive income from insurance, you must report the payment (as shown on your Form 1099-MISC.)

If you work at a caretaking agency

Caregivers pay taxes if caring for a family member is part of their full- or part-time job. For example, if a caregiver runs an adult in-home daycare, they must pay taxes when caring for a family member as part of their day job.

You must pay taxes if you’re caring for a family member and getting paid as part of your job at a caretaking agency.

In this case, your family role is considered your complete- or part-time job. Therefore, the agency will pay Social Security and employee benefit taxes, and it’s your responsibility to pay taxes on the income received.

You own a caretaking business

Yes, you pay taxes if you care for a family member as part of your caretaking business.

For example, you may run an in-home daycare for children or adults and care for several others alongside your family member. In this case, you’re probably a sole proprietor and are expected to report income on a Schedule C and Schedule SE form.

You employ an independent caretaker

In this case, you’re considered an employer, and the caretaker is your employee.

You pay Medicare or Social Security taxes if you employ an independent caretaker to care for your family member. Likewise, the caretaker must report the income you pay them. Check out care.com; they have advice and solutions for this tax situation.

Professional in-home caregivers are rarely considered independent contractors since you can tell them when, where, and how the work needs to be done.

If you have questions about how to hire and manage an independent caretaker in your home, we recommend a conversation with Mike George from Soaring Families. Mike has cared for his special-needs son for over 20 years and has fantastic advice about hiring and managing at-home professional support.

You hire a caretaker from an agency

No, you don’t need to pay taxes if you hire a caretaker from an agency. In this case, the agency is the caretaker’s employer. Therefore, they spend the employee Medicare and Social Security taxes, and their employees report income when filing taxes.

A family member pays you for care

A person can pay a family member for help at home, just like they would a professional health care worker. Many do. Itemize your work, including the date, time of creation, and amount paid.

According to JustAnswer, in 2022, if you get paid to be a caregiver and make more than $2,400, then whoever pays you is required to pay Medicare and Social Security taxes on the wages. Federal Medicare and Social Security taxes equal 15.3% of a caregiver's wages. Generally, you each pay half of the 15.3%.

How does the IRS classify a caregiver?

Caregivers have unique classifications when it comes to filing taxes. For example, family caregivers are usually not employees, so they don’t need to pay taxes. However, if they receive a Form 1099-MISC from insurance, they should report that income when filing.

If an individual hires an independent in-home caregiver to care for their family member, the caregiver is considered an employee. If you hire them, you are the employer. Under these circumstances, the caregiver must report their income and pay self-employment taxes.

For example, if the caregiver makes over $2,400 (as of 2022), the employer must issue a W-2 and pay Medicare and Social Security taxes on the caregiver’s wages.

Caregivers who are hired from an agency aren’t classified as employees of the family. Instead, they’re agency employees, and the agency is responsible for paying employee taxes.

Do family caregivers need 1099?

Family caregivers are rarely required to file a 1099-NEC. This form is reserved for business taxpayers who earn non-employee compensation (independent contractors). Since in-home caregivers are not considered independent contractors, a 1099-NEC is not required.

If the caregiver is an independent contractor, they will report earned income and pay self-employment taxes.

Family caregivers may also receive a Form 1099-MISC from insurance when they are paid from insurance. While they don’t pay self-employment tax on the amounts reported in this form, they say all compensation when filing taxes.

The only circumstances in which the family caregiver must file a 1099 is if they own a caregiving business. In this situation, the IRS considers the caregiver a sole proprietor. Therefore, the caregiver must pay self-employment taxes on any compensation they receive on behalf of their family member.

Is self-employment tax required for family caregivers?

Generally, self-employment tax is not required for family caregivers.

This applies only if the caregiver owns a caretaking business, such as in-home adult daycare. When this occurs, the family member is classified as a sole proprietor. As a result, they’re obligated to pay self-employment taxes on all income—including the income earned from caring for a family member.

Tax tips for family caregivers of an elderly parent

Caring for an elderly parent can be expensive. 80% of family caregivers have out-of-pocket costs related to their caregiving duties, accounting for 26% of their total income

Do family caregivers get a tax deduction?

It depends. Family caregivers may qualify for a tax deduction or a tax credit, depending on the circumstances.

Are there family caregivers tax credits?

Family members may qualify for a tax credit if they’ve hired an in-home caregiver to look after an elderly parent (or child).

To receive the tax credit, the person being cared for must meet one of the following qualifications, as outlined by the IRS:

- A spouse is physically or mentally unable to care for themselves and has lived at home for more than six months

- Another person is physically or mentally unable to care for themselves and has lived in the home for more than six months

Tax credits vary from year to year. But, according to JustAnswer, In 2022, the child and dependent care credits were worth up to $3,000 for one person or up to $6,000 for more than one person.

Medical expenses tax deductions

Individuals with medical expenses related to their family caregiving duties may qualify for tax deductions.

To qualify, the expenses must be specified in a health plan from a licensed healthcare provider, and the adult receiving the care must be a qualified dependent. If the costs qualify as medical expenses, the family caregiver needs an itemized list for a tax deduction.

General Info Social Security & Medicaid

Will social security pay me to take care of my relative?

No. Social Security does not pay individuals to take care of family members. However, Social Security payments can help pay for caregiving expenses, including medications, transportation, food, and more.

Social Security benefits can also be used to hire an in-home caregiver (either from an agency or a self-employed caregiver).

Will medicaid or medicare pay me to take care of my relative?

It depends on the state where caregiving happens. For example, in some states, government programs like Medicaid or VA directly pay for a home health aide—but a family member is not usually eligible to be paid caregiver.

Medicaid self-directed care facts

A few states have Medicaid Self-Directed Care programs, permitting the care recipient to choose a family member or friend as their paid caregiver.

California, New Jersey, New York, Washington, Oregon, and Hawaii, are a few states that pay family caregivers and provide ongoing caregiving resources and support.

Generally, many states with paid family caregiving incentives can provide anywhere from $600 weekly to $1,000-plus in family support. California is a standard gold state when it comes to supporting family caregivers.

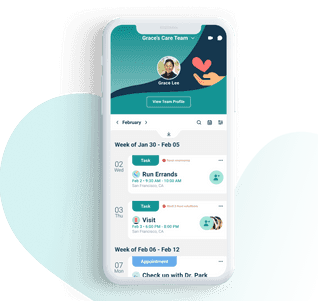

Taxes are Hard, Manage Your Care Team

If you’re a family caregiver, CircleOf is the app for you. Get help, communicate, organize, and collaborate with family and friends.

With CircleOf, you can ensure everyone is on the same page and stay updated on changes. Care happens; don't go it alone. Download CircleOf today.